Oracle

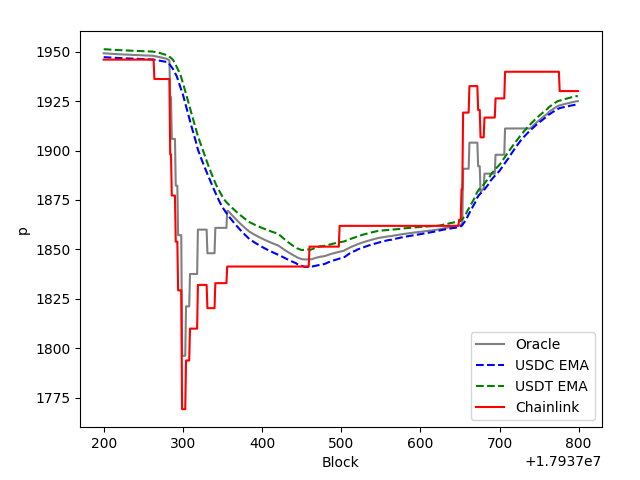

As crvusd markets use interal oracles, they utilizes in-house liquidity pools to aggregate the price of collateral. But there is a possibility to use Chainlink oracle prices as safety limits.

Warning

Every market has its own price oracle contract, which can be fetched by calling price_oracle_contract within the controller of the market. The wstETH oracle will be used for the purpose of this documentation. Please be aware that oracle contracts can vary based on the collateral token.

Tip

The formulas below use slightly different terminologies than the code to make them easier to read.

For abbreviations, see here.

EMA of TVL¶

_ema_tvl() calculates the exponential moving average (EMA) of the total value locked (TVL) for TRICRYPTO pools.

This value is subsequently used in the internal function _raw_price() to compute the weighted price of ETH.

_ema_tvl() -> uint256[N_POOLS]:

last_timestamp: public(uint256)

last_tvl: public(uint256[N_POOLS])

TVL_MA_TIME: public(constant(uint256)) = 50000 # s

@internal

@view

def _ema_tvl() -> uint256[N_POOLS]:

last_timestamp: uint256 = self.last_timestamp

last_tvl: uint256[N_POOLS] = self.last_tvl

if last_timestamp < block.timestamp:

alpha: uint256 = self.exp(- convert((block.timestamp - last_timestamp) * 10**18 / TVL_MA_TIME, int256))

# alpha = 1.0 when dt = 0

# alpha = 0.0 when dt = inf

for i in range(N_POOLS):

tvl: uint256 = TRICRYPTO[i].totalSupply() * TRICRYPTO[i].virtual_price() / 10**18

last_tvl[i] = (tvl * (10**18 - alpha) + last_tvl[i] * alpha) / 10**18

return last_tvl

\(tvl_i = \text{TVL of i-th pool}\) in TRICRYPTO[N_POOLS]

\(TS_i = \text{total supply of i-th pool}\) in TRICRYPTO[N_POOLS]

\(VP_i = \text{virtual price of i-th pool}\) in TRICRYPTO[N_POOLS] \(\text{last_tvl}_i = \text{smoothed TVL of i-th pool}\) in TRICRYPTO[N_POOLS]

ema_tvl¶

Oracle.ema_tvl() -> uint256[N_POOLS]:

Function to calculate the Total-Value-Locked (TVL) Exponential-Moving-Average (EMA) of the TRICRYPTO pools.

Returns: last_tvl (uint256[N_POOLS]).

Source code

@external

@view

def ema_tvl() -> uint256[N_POOLS]:

return self._ema_tvl()

@internal

@view

def _ema_tvl() -> uint256[N_POOLS]:

last_timestamp: uint256 = self.last_timestamp

last_tvl: uint256[N_POOLS] = self.last_tvl

if last_timestamp < block.timestamp:

alpha: uint256 = self.exp(- convert((block.timestamp - last_timestamp) * 10**18 / TVL_MA_TIME, int256))

# alpha = 1.0 when dt = 0

# alpha = 0.0 when dt = inf

for i in range(N_POOLS):

tvl: uint256 = TRICRYPTO[i].totalSupply() * TRICRYPTO[i].virtual_price() / 10**18

last_tvl[i] = (tvl * (10**18 - alpha) + last_tvl[i] * alpha) / 10**18

return last_tvl

last_tvl¶

Oracle.last_tvl(arg0: uint256) -> uint256:

Getter for the last_tvl of the tricrypto pool at index arg0.

Returns: last_tvl (uint256[N_POOLS]).

| Input | Type | Description |

|---|---|---|

arg0 | uint256 | Index |

Calculate Raw Price¶

The internal _raw_price() function calculates the raw price of the collateral token.

_raw_price(tvls: uint256[N_POOLS], agg_price: uint256) -> uint256:

@internal

@view

def _raw_price(tvls: uint256[N_POOLS], agg_price: uint256) -> uint256:

weighted_price: uint256 = 0

weights: uint256 = 0

for i in range(N_POOLS):

p_crypto_r: uint256 = TRICRYPTO[i].price_oracle(TRICRYPTO_IX[i]) # d_usdt/d_eth

p_stable_r: uint256 = STABLESWAP[i].price_oracle() # d_usdt/d_st

p_stable_agg: uint256 = agg_price # d_usd/d_st

if IS_INVERSE[i]:

p_stable_r = 10**36 / p_stable_r

weight: uint256 = tvls[i]

# Prices are already EMA but weights - not so much

weights += weight

weighted_price += p_crypto_r * p_stable_agg / p_stable_r * weight # d_usd/d_eth

crv_p: uint256 = weighted_price / weights

use_chainlink: bool = self.use_chainlink

# Limit ETH price

if use_chainlink:

chainlink_lrd: ChainlinkAnswer = CHAINLINK_AGGREGATOR_ETH.latestRoundData()

if block.timestamp - min(chainlink_lrd.updated_at, block.timestamp) <= CHAINLINK_STALE_THRESHOLD:

chainlink_p: uint256 = convert(chainlink_lrd.answer, uint256) * 10**18 / CHAINLINK_PRICE_PRECISION_ETH

lower: uint256 = chainlink_p * (10**18 - BOUND_SIZE) / 10**18

upper: uint256 = chainlink_p * (10**18 + BOUND_SIZE) / 10**18

crv_p = min(max(crv_p, lower), upper)

p_staked: uint256 = STAKEDSWAP.price_oracle() # d_eth / d_steth

# Limit STETH price

if use_chainlink:

chainlink_lrd: ChainlinkAnswer = CHAINLINK_AGGREGATOR_STETH.latestRoundData()

if block.timestamp - min(chainlink_lrd.updated_at, block.timestamp) <= CHAINLINK_STALE_THRESHOLD:

chainlink_p: uint256 = convert(chainlink_lrd.answer, uint256) * 10**18 / CHAINLINK_PRICE_PRECISION_STETH

lower: uint256 = chainlink_p * (10**18 - BOUND_SIZE) / 10**18

upper: uint256 = chainlink_p * (10**18 + BOUND_SIZE) / 10**18

p_staked = min(max(p_staked, lower), upper)

p_staked = min(p_staked, 10**18) * WSTETH.stEthPerToken() / 10**18 # d_eth / d_wsteth

return p_staked * crv_p / 10**18

\(price_{weighted} =\) weighted price of ETH

\(totalPrice_{weighted} =\) total weighted price of ETH

\(price_{eth} =\) price oracle of eth in the tricrypto pools w.r.t usdc/usdt

\(price_{usd} =\) price oracle of stableswap pool

\(price_{crvusd} =\) price oracle of crvusd

\(price_{stETH} =\) price of stETH w.r.t ETH

\(rate_{wstETH} =\) amount of stETH for 1 wstETH

raw_price¶

Oracle.raw_price() -> uint256: view

Function to calculate the raw price.

Returns: raw price (uint256).

Source code

@external

@view

def raw_price() -> uint256:

return self._raw_price()

@internal

@view

def _raw_price(tvls: uint256[N_POOLS], agg_price: uint256) -> uint256:

weighted_price: uint256 = 0

weights: uint256 = 0

for i in range(N_POOLS):

p_crypto_r: uint256 = TRICRYPTO[i].price_oracle(TRICRYPTO_IX[i]) # d_usdt/d_eth

p_stable_r: uint256 = STABLESWAP[i].price_oracle() # d_usdt/d_st

p_stable_agg: uint256 = agg_price # d_usd/d_st

if IS_INVERSE[i]:

p_stable_r = 10**36 / p_stable_r

weight: uint256 = tvls[i]

# Prices are already EMA but weights - not so much

weights += weight

weighted_price += p_crypto_r * p_stable_agg / p_stable_r * weight # d_usd/d_eth

crv_p: uint256 = weighted_price / weights

use_chainlink: bool = self.use_chainlink

# Limit ETH price

if use_chainlink:

chainlink_lrd: ChainlinkAnswer = CHAINLINK_AGGREGATOR_ETH.latestRoundData()

if block.timestamp - min(chainlink_lrd.updated_at, block.timestamp) <= CHAINLINK_STALE_THRESHOLD:

chainlink_p: uint256 = convert(chainlink_lrd.answer, uint256) * 10**18 / CHAINLINK_PRICE_PRECISION_ETH

lower: uint256 = chainlink_p * (10**18 - BOUND_SIZE) / 10**18

upper: uint256 = chainlink_p * (10**18 + BOUND_SIZE) / 10**18

crv_p = min(max(crv_p, lower), upper)

p_staked: uint256 = STAKEDSWAP.price_oracle() # d_eth / d_steth

# Limit STETH price

if use_chainlink:

chainlink_lrd: ChainlinkAnswer = CHAINLINK_AGGREGATOR_STETH.latestRoundData()

if block.timestamp - min(chainlink_lrd.updated_at, block.timestamp) <= CHAINLINK_STALE_THRESHOLD:

chainlink_p: uint256 = convert(chainlink_lrd.answer, uint256) * 10**18 / CHAINLINK_PRICE_PRECISION_STETH

lower: uint256 = chainlink_p * (10**18 - BOUND_SIZE) / 10**18

upper: uint256 = chainlink_p * (10**18 + BOUND_SIZE) / 10**18

p_staked = min(max(p_staked, lower), upper)

p_staked = min(p_staked, 10**18) * WSTETH.stEthPerToken() / 10**18 # d_eth / d_wsteth

return p_staked * crv_p / 10**18

Chainlink Limits¶

The oracle contracts have the option to utilize Chainlink prices, which serve as safety limits. When enabled, these limits are triggered if the Chainlink price deviates by more than 1.5% (represented by BOUND_SIZE) from the internal price oracles.

Chainlink limits can be turned on and off by calling set_use_chainlink(do_it: bool), which can only be done by the admin of the Factory contract.

use_chainlink¶

Oracle.use_chainlink() -> bool:

Getter method to check if chainlink oracles are turned on or off.

Returns: True or False (bool).

set_use_chainlink¶

Oracle.set_use_chainlink(do_it: bool):

Guarded Method

This function is only callable by the admin of the Factory contract.

Function to toggle the usage of chainlink limits.

| Input | Type | Description |

|---|---|---|

do_it | bool | Bool to toggle the usage of chainlink oracles |

Source code

Terminology used in Code¶

| terminology used in code | |

|---|---|

| \(\alpha\) | alpha |

| \(\exp\) | exp(power: int256) -> uint256: |

| \(TS_i\) | TRICRYPTO[i].totalSupply() |

| \(VP_i\) | TRICRYPTO[i].virtual_price() |

| \(price_{eth}\) | p_crypto_r |

| \(price_{usd}\) | p_stable_agg |

| \(price_{crvusd}\) | p_stable_r |

| \(price_{weighted}\) | weighted_price |

| \(totalETH_{price}\) | crv_p |

Contract Info Methods¶

N_POOLS¶

Oracle.N_POOLS() -> uint256:

Getter for the number of external pools used by the oracle.

Returns: number of pools (uint256).

TRICRYPTO¶

Oracle.TRICRYPTO(arg0: uint256) -> uint256:

Getter for the tricrypto pool at index arg0.

Returns: last_tvl (uint256[N_POOLS]).

| Input | Type | Description |

|---|---|---|

arg0 | uint256 | Index |

TRICRYPTO_IX¶

Oracle.TRICRYPTO_IX(arg0: uint256) -> uint256:

Getter for the index of ETH in the tricrypto pool w.r.t the coin at index 0.

Returns: Index of ETH price oracle in the tricrypto pool (uint256).

Tip

Returns 1, as ETH price oracle index in the tricrypto pool is 1. If the same index would be 0, it would return the price oracle of ETH. Their prices are all w.r.t the coin at index 0 (USDC or USDT).

| Input | Type | Description |

|---|---|---|

arg0 | uint256 | Index of TRICRYPTO |

STABLESWAP_AGGREGATOR¶

Oracle.STABLESWAP_AGGREGATOR() -> address:

Getter for contract of the crvusd price aggregator.

Returns: contract (address).

STABLESWAP¶

Oracle.STABLESWAP(arg0: uint256) -> address:

Getter for the stableswap pool at index arg0.,

Returns: stableswap pool (address).

| Input | Type | Description |

|---|---|---|

arg0 | uint256 | Index of STABLESWAP |

STABLECOIN¶

Oracle.STABLECOIN() -> address:

Getter for the contract address of crvUSD.

Returns: crvUSD contract (address).

FACTORY¶

Oracle.FACTORY() -> address:

Getter for the contract address of the Factory.

Returns: factory contract (address).

BOUND_SIZE¶

Oracle.BOUND_SIZE() -> uint256:

Getter for the bound size of the chainlink oracle limits. This essentially is the size of the safety limits.

Returns: bound size (uint256).

STAKEDSWAP¶

Oracle.STAKEDSWAP() -> address:

Getter for the stETH/ETH stableswap pool.

Returns: pool contract (address).

WSTETH¶

Oracle.WSTETH() -> address:

Getter for the wstETH contract address.

Returns: wstETH contract (address).

last_timestamp¶

Oracle.last_timestamp() -> uint256:

Getter for the last timestamp when price_w() was called.

Returns: timestamp (uint256).

TVL_MA_TIME¶

Oracle.TVL_MA_TIME() -> uint256:

Getter for the Exponential-Moving-Average time.

Returns: ema time (uint256).

price¶

Oracle.price() -> uint256: view

Function to calculate the raw price of the collateral token.

Returns: raw price (uint256).

Source code

@external

@view

def price() -> uint256:

return self._raw_price(self._ema_tvl(), STABLESWAP_AGGREGATOR.price())

@internal

@view

def _raw_price(tvls: uint256[N_POOLS], agg_price: uint256) -> uint256:

weighted_price: uint256 = 0

weights: uint256 = 0

for i in range(N_POOLS):

p_crypto_r: uint256 = TRICRYPTO[i].price_oracle(TRICRYPTO_IX[i]) # d_usdt/d_eth

p_stable_r: uint256 = STABLESWAP[i].price_oracle() # d_usdt/d_st

p_stable_agg: uint256 = agg_price # d_usd/d_st

if IS_INVERSE[i]:

p_stable_r = 10**36 / p_stable_r

weight: uint256 = tvls[i]

# Prices are already EMA but weights - not so much

weights += weight

weighted_price += p_crypto_r * p_stable_agg / p_stable_r * weight # d_usd/d_eth

crv_p: uint256 = weighted_price / weights

use_chainlink: bool = self.use_chainlink

# Limit ETH price

if use_chainlink:

chainlink_lrd: ChainlinkAnswer = CHAINLINK_AGGREGATOR_ETH.latestRoundData()

if block.timestamp - min(chainlink_lrd.updated_at, block.timestamp) <= CHAINLINK_STALE_THRESHOLD:

chainlink_p: uint256 = convert(chainlink_lrd.answer, uint256) * 10**18 / CHAINLINK_PRICE_PRECISION_ETH

lower: uint256 = chainlink_p * (10**18 - BOUND_SIZE) / 10**18

upper: uint256 = chainlink_p * (10**18 + BOUND_SIZE) / 10**18

crv_p = min(max(crv_p, lower), upper)

p_staked: uint256 = STAKEDSWAP.price_oracle() # d_eth / d_steth

# Limit STETH price

if use_chainlink:

chainlink_lrd: ChainlinkAnswer = CHAINLINK_AGGREGATOR_STETH.latestRoundData()

if block.timestamp - min(chainlink_lrd.updated_at, block.timestamp) <= CHAINLINK_STALE_THRESHOLD:

chainlink_p: uint256 = convert(chainlink_lrd.answer, uint256) * 10**18 / CHAINLINK_PRICE_PRECISION_STETH

lower: uint256 = chainlink_p * (10**18 - BOUND_SIZE) / 10**18

upper: uint256 = chainlink_p * (10**18 + BOUND_SIZE) / 10**18

p_staked = min(max(p_staked, lower), upper)

p_staked = min(p_staked, 10**18) * WSTETH.stEthPerToken() / 10**18 # d_eth / d_wsteth

return p_staked * crv_p / 10**18

price_w¶

Oracle.price_w() -> uint256:

Function to obtain the oracle price of the collateral token and update last_tvl and last_timestamp. This function is used in the AMM.

| Input | Type | Description |

|---|---|---|

arg0 | uint256 | last_tvl of tricrypto pool at index arg0 |