CryptoSwap Exchange: Overview

The Automatic Market-Making with Dynamic Peg (CryptoSwap) algorithm introduces a new approach for creating liquidity for assets which are not necessarily pegged to each other.

The core of this algorithm lies in its ability to concentrate liquidity around a price point determined by an internal oracle, adjusting this price in a way that balances potential losses and system profits.

Key features include the use of transformed pegged invariants, a method for quantifying profits and losses, and the CurveCrypto invariant, specifically designed for efficient execution on the EVM.

The algorithm also incorporates a dynamic fee structure that responds to changing market conditions. This approach seeks to enhance liquidity provision and optimize returns for liquidity providers.

Whitepaper

For a detailed overview of the design, please read the official whitepaper.

Implementations¶

There have been several implementations of the CryptoSwap algorithm:

Contract Source

Source code is available on GitHub:

- genesis contracts: https://github.com/curvefi/curve-crypto-contract

- twocrypto-ng: https://github.com/curvefi/twocrypto-ng

- tricrypto-ng: https://github.com/curvefi/tricrypto-ng

| Type | Description |

|---|---|

CryptoSwap | Genesis two-coin volatile asset pool integration. |

Tricrypto | Genesis three-coin volatile asset pool integration. |

TwoCrypto-NG | Improved version of CryptoSwap, more here. |

Tricrypto-NG | Improved version of Tricrypto, more here. |

Parameters¶

Because different trading pairs can exhibit drastically different price dynamics, Curve v2 offers a variety of tunable parameters that can be used to optimize for different types of assets.

The CryptoSwap market-making algorithm contains of three different classes of parameters:

- Bonding Curve:

Aandgamma - Price Scaling:

ma_time,allowed_extra_profitandadjustment_step - Fees:

mid_fee,out_feeandfee_gamma

Explainer for Parameters

An excellent deep-dive article on the parameters: https://nagaking.substack.com/p/deep-dive-curve-v2-parameters.

Bonding Curve Parameters¶

Similar to many AMMs, Curve v2 employs a bonding curve to determine asset prices according to the pool's supply of each asset. To centralize liquidity around the midpoint of the bonding curve, Curve v2 adopts an invariant that falls between the StableSwap (Curve v1) approach and the constant-product method used by platforms like Uniswap and Balancer.

A: regulates the concentration of liquidity at the core of the bonding curvegamma: regulates the overall breadth of the curve

Price Scaling¶

Curve v2 pools automatically adjust liquidity to optimize depth close to the prevailing market rates, reducing slippage. This is achieved by tracking a continuous EMA (exponential moving average) of the pool's latest exchange rates (referred to as an "internal oracle") and reallocating liquidity around this EMA only when it's economically beneficial for LPs.

ma_time: regulates the duration of the EMA price oracleallowed_extra_profit: excess profit required to allow price re-peggingadjustment_step: minimum size of price scale adjustments

Fees¶

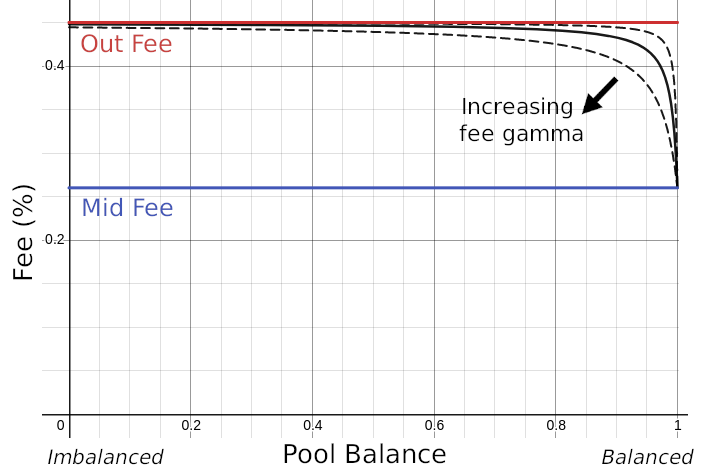

Fees are charged based on the balance/imbalance of the pool. Fee is low when the pool is balanced and increases the more it is imbalanced.

There are three different kind of fees:

fee_mid: charged fee when pool is perfectly balanced (minimum possible fee).out_fee: charged fee when pools is completely imbalanced (maximum possible fee).fee_gamma: determines the speed at which the fee increases when the pool becomes imbalanced. A low value leads to a more rapid fee increase, while a high value causes the fee to rise more gradually.